5 new challenges for a non-executive director

9 August 2018 By Guest writer Sue Tyrer

Being a non-executive director is no longer a part-time occupation. For those thinking about a non-executive portfolio as a wind-down activity after retirement, they would do well to read the latest Guidance on Board Effectiveness, issued by the Financial Reporting Council (FRC) in July 2018.

In this blog, I want to highlight what the new expectations are for non-execs, but also what we, as executive search consultants, increasingly look for when making non-executive appointments.

New guidelines on whistleblowing

The Financial Conduct Authority (FCA) brought in new rules on whistleblowing in 2016 and the latest FRC guidance embeds these for boards more generally. They advise, “Having policies in place that encourage individuals to raise concerns is a core part of an ethical and supportive business culture. Whistleblowing policies that offer effective protection from retaliation, as well as policies that support anti-bribery and corruption legislation are essential components of this.”

It is likely that executives and non-executive directors on boards will face new challenges and alerts from employees, stakeholders and customers for the first time and will need to demonstrate thoughts, views and any experience of handling these types of issues.

Culture is now a critical issue

The latest FRC guidance references culture 37 times – and the whistleblowing policy forms part of this focus on ethics and culture.

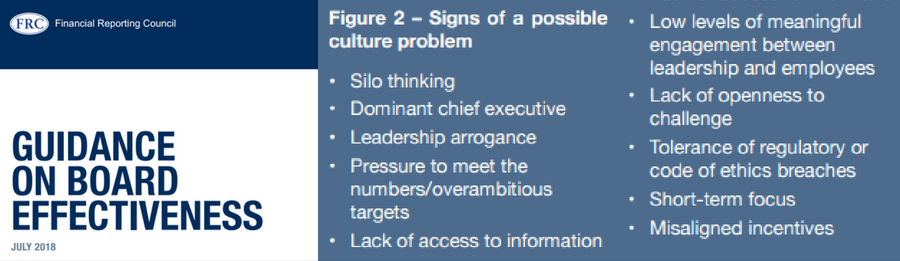

As a non-executive, if your expectation is to turn up to board meetings once a month and maybe a committee or two, how will you have your finger on the pulse of a company or organisation’s culture? While the guidance lists ten signs of a possible culture problem, anyone who has sat on a board will know the challenge of getting under the skin of both the management team and the wider culture.

Perhaps one of the best examples of this problem can be seen in the Libor-fixing scandal at Barclays. Bob Diamond, chief executive, said he had ‘no knowledge that anything untoward was taking place…’ insisting he was never made aware of the issues. Yet when the fixing became known, it was clear these were widespread practices rather than the actions of one or two rogue traders.

There was considerable public debate as to what was the worst aspect of this from a board perspective – the practice itself or that the chief executive and others said they had no knowledge of it. And the question for non-executives is – if the leadership team say they don’t know, how will the non-executives find out?

Again, the Guidance lists the sorts of information that can help boards to understand a culture – from employee surveys to exit interviews – but you have to say, would any of these have shown up the Libor-fixing practice?

The only way is for non-executives to spend time in the company or organisation, getting to meet employees informally and making their own assessment of culture and practices. And that requires considerable time commitment beyond the basic role.

From an executive search view, we want to find someone who will engage with the business as a whole, not just talking to people behind the till but who seek out leading players and authorities both large and small and have a view on the bigger challenges – and solutions.

Remuneration in the spotlight

Executive pay, gender pay gaps and board rewards are increasingly the focus of shareholder revolts.

BT was the latest corporate to be hit by a significant shareholder rebellion over its outgoing chief executive Gavin Patterson’s £2.3m pay packet.

At its annual meeting in Edinburgh, 34.2% of investors voted against the telecoms group’s remuneration report, including the payout to Patterson.

The FRC Guidance has 51 references to remuneration – and anyone sitting on a remuneration committee will know just how complex pay deals are these days. Any non-executive is having to weigh up the value of the executive, public and shareholder perception of pay awards against the legal constraints of an executive’s employment contract.

Aspiring non executives would do well do spend time understanding the current issues and trends in remuneration and pay as this is a reoccurring agenda item for all boards going forward.

A contemporary non-executive director

There was a time when a chair would look for non-executive directors to be steeped in their sector and in many companies it is still an essential requirement. The difference is that they are looking for non executives who understand the future of their sector. There are however more open briefs with boards wanting someone who can bring in wider insights – so a non-executive on a retail board might share what is happening in logistics as both a potential risk but also an opportunity for strategy.

Boards are looking for non-executives who attend forums, conferences and network with other sectors so they contribute fresh thinking as to what is happening in the wider world. They are also looking for customer insight – as an example, a non-executive who understands marketing to millennials rather than necessarily having sector experience.

Frightening pace of change

The traditional non-executive skills are still important – an ability to read a balance sheet, understanding of risks and their mitigation and an ability to contribute to strategy.

However, the non-executive directors that stand out are those who can add value in terms of changing markets, technology and spotting disruption and threats coming over the horizon.

Cyber security is on on the agenda of every board in the country – yet how many non-executives have made an effort to understand the issues and really know the questions to raise with the IT Director? And more importantly make a judgement about the answers they get.

At Orcid, we are delighted to be supporting the Next-Up conference in November. With 10 young tech entrepreneurs talking about the future of technologies from cyber security to big data and virtual augmented reality, this is an easy way for non-executive directors and advisers to keep up to date and demonstrate that wider interest and conversation when discussing non-executive roles with chairpeople.

We hope to see you there!